“Begin with the End in Mind”: what a simple, yet profound concept. It is one of the habits of Stephen Covey’s 7 Habits of Highly Effective People. It is so simple, but too often overlooked.

When entrepreneurs start companies they often have vivid visions of success. Through the business planning process, entrepreneurs often develop and work through the various issues that need to be addressed in order to obtain the commercial success for which they are looking. But, what is the desired end state or exit? Or, is death the only exit? Seriously though, is the exit, sale of the company within 5 or 10 years? Is it working with and growing the company until retirement, with younger management or the next family generation buying out the company? Is it an intellectual property holding company collecting royalties from various licensees? Is it the sale of stock after a public offering? Too often, entrepreneurs dedicate only two or three sentences in the business plan to the intended exit, using almost boilerplate language. Of course, only time will tell how things will end up, but having a vision for a desired outcome will help drive decisions and planning, making your desired outcome more likely to come to fruition.

Backwards Planning Process

With the desired end in mind, the business planning process and capitalization strategy development can truly begin. It is what is referred to as the backwards planning process. Many people do this instinctively as part of their normal planning. Identify what assuredly has to happen in order to get you in position to meet your desired end state. Think of these “have to happen” items as interim objectives. It may be a certain level of sales or EBITDA, successful completion of a lead drug phase II clinical trial, a successful public offering, etc. Then, identify what conditions, tasks, and shorter-term objectives it will take to meet those interim objectives. Continue to repeat that process until you are back in time to the present day.

Capitalization Strategy

When looking at your capitalization strategy, it is a very similar process. In fact, it should go hand in hand with business planning. You also need to consider though the needs, expectations, and desires of your sources of capital—meaning your prospective investors, bankers, government agencies, customers, etc. Figure out what it will likely take in order for you to get the sources and amount of capital you need to reach your desired end state. When looking at equity capital, think through valuation issues, dilution, capitalization structure, liquidation preferences, etc. Again though, start with the end in mind and work back through time, through each anticipated round of investment, each grant and grant phase, etc. It will help you develop a coherent strategy and identify what needs to be done to get you where you want to be.

Understanding Investor Needs

I’ll go through more on investor needs, expectations, and desires in later posts, but for present purposes I will touch on two very basic ones to illustrate some of the considerations to include in developing your capitalization strategy: the amounts of money that different types of investors invest as well as when in a company’s life cycle those investors invest.

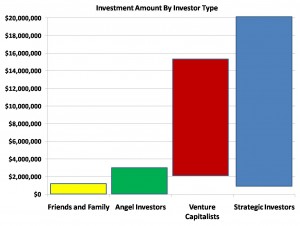

Here are a couple of charts to consider. The first one shows the ranges of investment amount by investor type. The chart contains generalizations. Of course, sometimes investments are outside of these ranges for unique deals or situations or current market conditions. For instance, this year we are in relatively tight markets so both the number of deals and the amount of investments by group are generally down.

Investor Amount by Investor Type

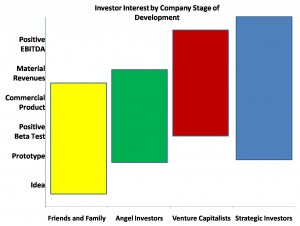

This next chart shows the stage of company development that investors generally invest at. As with the amount of investment, one see deals outside of these ranges based on unique opportunities or situations or the general market conditions. Also, there are variations by industry. For example, in therapeutics, the categories on the y-axis would be different: they would likely include positive preclinical animal data, filing a new drug application, commencing the clinical trial, completing phase I of the trial, etc.

Investor Interest by Company Stage of Development

The point to take from all this is that developing a coherent capitalization strategy is a deliberate process. It should take into account the entire time between today and the day you meet you desired end state, not just where your next grant or equity financing is going to come from. Have a long term strategy will actually help guide you through many decisions and assessments of opportunities that you will likely encounter.